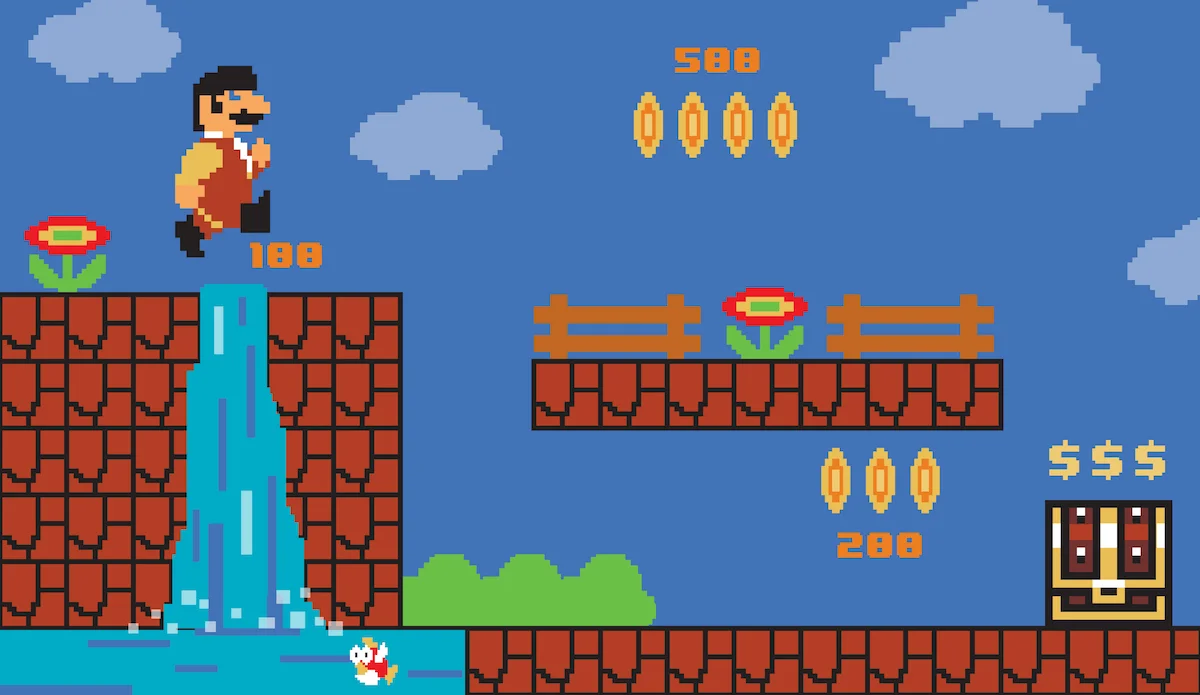

WHAT YOU SHOULD KNOW ABOUT PRICING WATERFALLS, CLIFFS, AND FENCES

By Tim Williams, Ignition Consulting Group

Has your firm ever run into a pricing cliff, cascaded off a pricing waterfall, or put up a pricing fence? Chances are, no. That's because pricing in most professional firms like agencies is an oversimplified afterthought that consists of adding up your costs and calling it a price. But in client organizations, pricing is a core competency -- separate from finance -- that navigates through the minefields of pricing psychology to optimize profit margins for their company.

Why should professional firms care? Because due to our lack of curiosity about modern pricing practices, we subject our firms to perpetual suboptimal profit margins, severely limiting our ability to attract and pay the top talent required to sustain the success of a knowledge-based firm like an ad agency.

The regressive cost-plus approach to compensation actually places a self-imposed ceiling on our profit. If your view is that your firm's inventory consists of a warehouse full of "hours," you can do the math and quickly understand that a finite number of employees working a finite number of hours charged at a finite hourly rate equals a finite profit margin. What other kind of business limits the amount of profit they can make?

Coming soon: the 100th birthday of the billable hour

Contrast the 97-year-old hourly billing approach (created in 1919 by a Boston lawyer) with the modern pricing practices of your client companies. Rather than pricing based on a standard recipe like the hourly rate, the global business community is in the middle of a vibrant pricing revolution. Building upon an ever-evolving understanding of pricing psychology, companies from auto manufacturers (Tesla) to theme parks (Disney) are pioneering new approaches to capturing the value they create. They are future-proofing their profit margins by aligning their pricing practices with customer perceptions of value.

Most professional firms are stuck in an outmoded and unimaginative paradigm that equates price directly with cost, thereby treating pricing as a formulaic exercise accomplished by a calculator. That's quite remarkable for a business filled with knowledge workers who create value through innovation, insight, and expertise. Especially when considering that even car parking garages are able to apply 21st-century techniques to their pricing structures. At London's Heathrow Airport, there is no price per hour for a parking space. Instead, the garages at this busy airport adjust their prices based on their customers' willingness to pay. As the parking spaces fill with cars, the prices go up as the garages apply the principles of dynamic pricing.

So a parking garage can be part of the pricing revolution and a professional firm cannot? Many professionals make the unreasonable assertion that their services are regarded as too much of a commodity. More of a commodity than wireless service? AT&T's latest price increase was a masterstroke. As observed by pricing professional Rags Srinivasan, the telecom's approach was not a lazy across-the-board rate hike, but rather an artful combination of 1) Dropping their lowest priced option 2) Getting rid of data overages and 3) Actually lowering their higher-priced plans.

No such thing as a commodity

If you've never read a pricing book, taken a pricing course, or studied the principles of pricing psychology, you can't credibly proclaim that your business is involuntarily tethered to a system dictated by professional procurement agents. An increasing number of progressive firms across the globe are proving that it is indeed possible to pierce through the artificial profit ceiling that other time-driven firms have created for themselves. The first step is to acknowledge that while your firm may have outstanding abilities in the science of costing, you haven't invested the necessary time and energy to learn the art of pricing.

____________________

JUST SO YOU KNOW

A pricing waterfall is the cascading sequence by which your official "list" price gets reduced through a series of discounts or even negotiation concessions, resulting in the actual "pocket" price.

Pricing fences are the walls that separate the various pricing options offered to a customer, seen on virtually every software sign-up page on the internet. They serve to segment customers based on what they're willing to pay for.

And a pricing cliff is what you hit when you've pushed one of your pricing options beyond your customers' willingness to pay.